Why Skills-First Leadership Is Replacing the Ivy League Playbook in the C-Suite

The old prestige pyramid—where Ivy League degrees and blue-chip consulting backgrounds paved the way to the CEO seat—is cracking.

January 26, 2022: -Investors may be playing with fire. According to Morgan Stanley’s Mike Wilson, the S&P 500 is vulnerable to a 10% plunge despite Monday’s late buying binge. He is warning investors are dangerously downplaying a collision amid a tightening Federal Reserve and slowing growth.

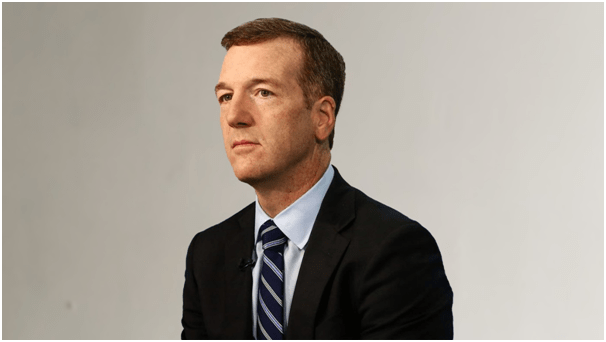

“This type of action is just not comforting. I don’t think anybody is going home feeling like they’ve got this thing nailed even if they bought the lows,” the firm’s chief U.S. equity strategist and chief investment officer told CNBC.

Wall Street has not seen an intraday reversal this large since the 2008 financial crisis. In a Monday’s session, the Nasdaq bounced back from a 4% drop while the Dow was off 3.25% at its low. At one point, the blue-chip index was decreased to 1,015 points. But by the close, the Nasdaq, Dow, and S&P 500 were all in positive territory.

Wilson, the market’s most giant bear, expects the painful drop will happen within the next three to four weeks. He is anticipating challenging earnings reports and guidance will give investors a wake-up call regarding the slow growth.

“I need something less than 4,000 to get constructive,” said Wilson. “I do think that’ll happen.”

His strategy was that the Double down on defensive trades ahead of the predicted setback. He warned virtually every S&P 500 group will see more trouble because of the frothiness and makes decisions on a stock-by-stock basis.

“We’re not making a big bet on cyclical here such as we were a year ago because growth is decelerating. People got too excited on these cyclical parts of the market, and we think that’s wrong-footed,” he said. “There’s going to be a payback in demand this year. We do think margins are a potential issue.”

Wilson doubts the Federal Reserve’s two-day policy meeting, which kicks off Tuesday, will provide meaningful comfort to investors.

On Monday, the S&P 500 closed at 4410.13, 8.5% less than the index’s all-time high hit on January 4. Wilson’s year-end price target is 4,400.

The old prestige pyramid—where Ivy League degrees and blue-chip consulting backgrounds paved the way to the CEO seat—is cracking.

Loud leaders once ruled the boardroom. Charisma was currency. Big talk drove big valuations.

But the CEOs who make history in downturns aren’t the ones with the deepest cuts

Companies invest millions in leadership development, yet many of their best executives leave within a few years. Why?

The most successful business leaders don’t just identify gaps in the market; they anticipate future needs before anyone else.

With technological advancements, shifting consumer expectations, and global interconnectedness, the role of business leaders

Following a distinguished Law Enforcement career Joe McGee founded The Securitatem Group to provide contemporary global operational specialist security and specialist security training products and services for private clients, corporate organisations, and Government bodies. They deliver a wide range of services, including complete end-to-end protection packages, close protection, residential security, protection drivers, and online and physical installations. They provide covert and overt investigations and specialist surveillance services with a Broad range of weapons and tactical-based training, including conflict management, risk and threat management, tactical training, tactical medicine, and command and control training.

Jay Wright, CEO and Co-Owner of Virgin Wines infectious energy, enthusiasm, passion and drive has been instrumental in creating an environment that encourages talent to thrive and a culture that puts the customer at the very heart of every decision-making process.

Fabio de Concilio is the visionary CEO & Chairman of the Board at Farmacosmo, a leading organization dedicated to mental health and community support services. With a deep commitment to identifying and meeting customer needs, Fabio ensures that high standards are maintained across the board.

Character Determines Destiny – so said Aristotle. And David CM Carter believes that more than anything else. For David, it has been numerous years of research into codifying Entelechy Academy’s 54 character qualities that underpin everything he stands for as a leader and teacher.

Leave us a message

Subscribe

Fill the form our team will contact you

Advertise with us

Fill the form our team will contact you