Why Skills-First Leadership Is Replacing the Ivy League Playbook in the C-Suite

The old prestige pyramid—where Ivy League degrees and blue-chip consulting backgrounds paved the way to the CEO seat—is cracking.

July 8, 2021: -On Wednesday, British fintech giant Wise started trading at £8 a share in its highly anticipated debut, which values the company at £8 billion or $11 billion.

The money transfer firm opted to list in London through a direct listing, a method of being public pioneered by Spotify in the U.S. in the year 2018. Rather than increasing money in an IPO, Wise’s private backers are selling their existing shares to the public.

Wise has introduced a program called OwnWise that lets users own a stake in the company in an unusual move. The customers participating in the scheme would be entitled to receive bonus shares for up to £100 after 12 months.

“It feels very consistent with their brand, particularly the direct listing,” Russ Shaw, founder of Tech London Advocates, told CNBC.

“They’re bypassing what can often be a costly process to get through an IPO, and going directly to the market, direct to their customers, trying to cut out as many intermediary costs as possible,” he added.

Wise is one of Britain’s most prominent and best-known fintech unicorns. Its listing is seen as a validation for the burgeoning fintech sector of the country, producing multibillion-dollar firms such as Revolut and Checkout.com and attracted $4.1 billion of investment in the year 2020.

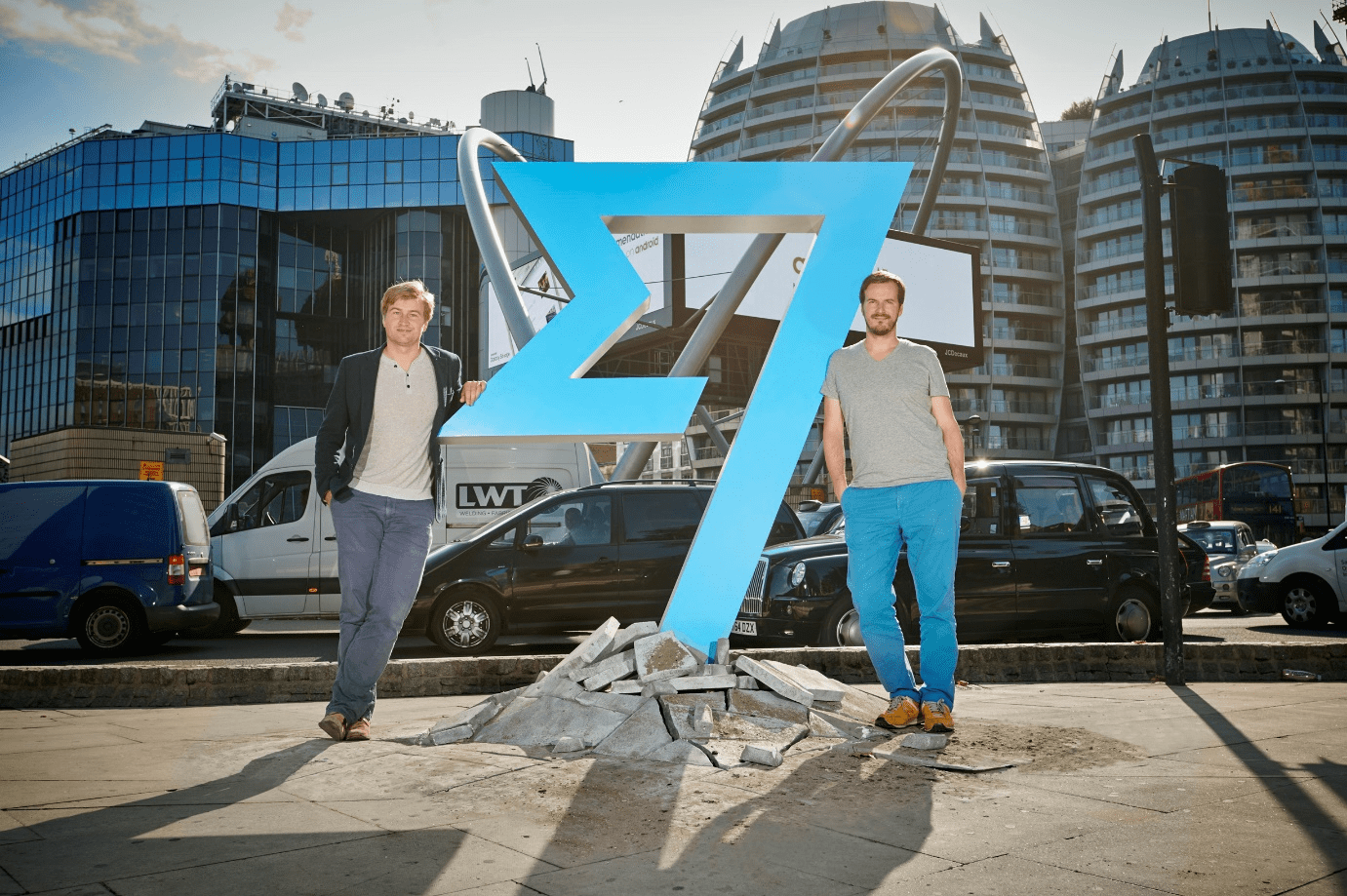

The company was discovered in 2010 by Estonian friends Taavet Hinrikus and Kristo Käärmann. Frustrated with the steep fees they faced sending money between the U.K. and Estonia, and the pair worked out a new way to make cross-border transfers at the real exchange rate.

Wise, which makes money by cross-border transaction fees, has been profitable since 2017. In 2021, the company doubled profits to £30.9 million while revenues climbed 39% to £421 million.

Wise’s debut is a big win for the U.K., which is vying to attract more prominent tech companies to its stock market with reforms to London’s listing rules. At this time, as the first direct listing of a tech company in London, it’s also a risky gamble.

The comp decision to list with a dual-class share structure that gives founders and early investors enhanced voting rights may also prove controversial. Food delivery firm Deliveroo plunged nearly 30% on the first day of trading, in part due to governance concerns around its dual-class stock structure.

The old prestige pyramid—where Ivy League degrees and blue-chip consulting backgrounds paved the way to the CEO seat—is cracking.

Loud leaders once ruled the boardroom. Charisma was currency. Big talk drove big valuations.

But the CEOs who make history in downturns aren’t the ones with the deepest cuts

Companies invest millions in leadership development, yet many of their best executives leave within a few years. Why?

The most successful business leaders don’t just identify gaps in the market; they anticipate future needs before anyone else.

With technological advancements, shifting consumer expectations, and global interconnectedness, the role of business leaders

The Fort McMurray First Nation Group of Companies is the wholly owned business entity of Fort McMurray 468 First Nation. It was established in 1987 as Christina River Enterprises, and the organization rebranded as FMFN Group in 2021. Providing Construction, Custodial, Petro-Canada Fuel & Convenience Store, and Transportation services to a broad portfolio of customers, the Group of Companies is creating financial stability and prosperity for the Nation.

Maushum Basu is a visionary leader who inspires his team with a clear, compelling purpose. Unafraid to take calculated risks, he understands that growth often stems from change and innovation. His deep commitment to both Airia Brands, Inc.

When speaking with Martin Paquette, one thing is immediately apparent: he’s honest. His transparency is refreshing. While many shy away from such vulnerability, Paquette sees it as a force to reckon with. The incredible emotional intelligence speaks to years of looking within—it’s also what allows him to acknowledge his mistakes gracefully and use them as opportunities to innovate.

Marina Charriere, CEO of Star Drug Testing Services, Star Drug Testing Services (Windsor Park), and First Defence Face Masks go hand in hand. Star is a drug and alcohol testing facility, and First D F M is a face mask company.

Leave us a message

Subscribe

Fill the form our team will contact you

Advertise with us

Fill the form our team will contact you