Why Skills-First Leadership Is Replacing the Ivy League Playbook in the C-Suite

The old prestige pyramid—where Ivy League degrees and blue-chip consulting backgrounds paved the way to the CEO seat—is cracking.

April 6, 2022: -The number of public listings in greater China decreased hugely in the first quarter of the year but still performed better than other global markets, data from consultancy EY showed.

Overall, Greater China had a 28% drop in the number of initial public offerings, although IPO activity in Hong Kong was slower than in mainland China.

“Hong Kong saw slower IPO activity due to recent market volatility, an outbreak of Omicron cases, and a relatively bigger fall in the local stock market indices,” said EY.

Hong Kong had just 12 IPO deals, a drop of over 60% compared to a year ago.

Chinese tech shares have plummeted over the previous year, hit by China’s regulatory crackdown and ongoing tensions with the U.S. The Hang Seng Tech index is down nearly 44% compared to a year ago, while the Hang Seng index has fallen by 22% in the same period.

“While Mainland China saw a small decline in deal numbers, proceeds increased due to hosting three of the seven mega IPOs in Q1 2022,” the firm said.

While the number of IPOs decreased, proceeds from the overall greater China listings increased by 2% compared to a year ago, or $30.1 billion.

The tumble in listing activity in China and Hong Kong followed the same trend in the rest of Asia-Pacific, where IPOs also decreased but not as steeply, at 16% year-on-year. IPO proceeds in Asia-Pacific rose by 18%.

The decline in Asia-Pacific was less severe than IPOs globally – with a fall of 37% in the first quarter compared to a year ago, or 321 listings. Global IPOs are raising $54.4 billion in proceeds from January to March this year, a drop of 51% in the same period.

“The sudden reversal can be attributed to various issues,” EY said. They include geopolitical tensions, stock market volatility, and price correction in over-valued stocks from recent IPOs.

EY has attributed the drop to growing concerns about rising commodity and energy prices, the impact of inflation, potential interest rate hikes, and the “COVID-19 pandemic risk continuing to hold back a full global economic recovery.”

In line with the sharp decline in global IPO activity, a “considerable” fall in SPAC IPOs, the public listing for exceptional purpose acquisition companies.

Mega listings, which EY defined as having proceeds of over $1 billion, also fell. It said several IPO launches were postponed due to “market uncertainty and instability.”

The old prestige pyramid—where Ivy League degrees and blue-chip consulting backgrounds paved the way to the CEO seat—is cracking.

Loud leaders once ruled the boardroom. Charisma was currency. Big talk drove big valuations.

But the CEOs who make history in downturns aren’t the ones with the deepest cuts

Companies invest millions in leadership development, yet many of their best executives leave within a few years. Why?

The most successful business leaders don’t just identify gaps in the market; they anticipate future needs before anyone else.

With technological advancements, shifting consumer expectations, and global interconnectedness, the role of business leaders

The Fort McMurray First Nation Group of Companies is the wholly owned business entity of Fort McMurray 468 First Nation. It was established in 1987 as Christina River Enterprises, and the organization rebranded as FMFN Group in 2021. Providing Construction, Custodial, Petro-Canada Fuel & Convenience Store, and Transportation services to a broad portfolio of customers, the Group of Companies is creating financial stability and prosperity for the Nation.

Maushum Basu is a visionary leader who inspires his team with a clear, compelling purpose. Unafraid to take calculated risks, he understands that growth often stems from change and innovation. His deep commitment to both Airia Brands, Inc.

When speaking with Martin Paquette, one thing is immediately apparent: he’s honest. His transparency is refreshing. While many shy away from such vulnerability, Paquette sees it as a force to reckon with. The incredible emotional intelligence speaks to years of looking within—it’s also what allows him to acknowledge his mistakes gracefully and use them as opportunities to innovate.

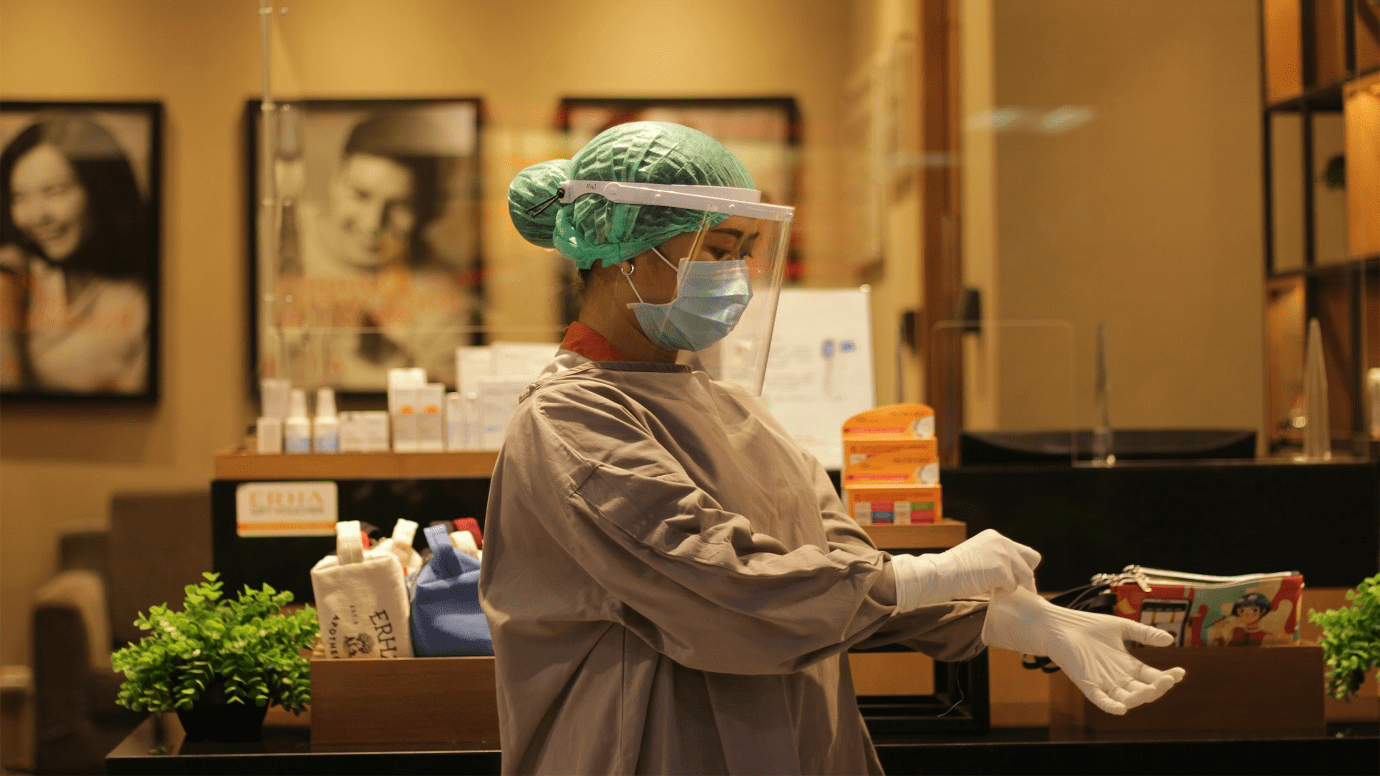

Marina Charriere, CEO of Star Drug Testing Services, Star Drug Testing Services (Windsor Park), and First Defence Face Masks go hand in hand. Star is a drug and alcohol testing facility, and First D F M is a face mask company.

Leave us a message

Subscribe

Fill the form our team will contact you

Advertise with us

Fill the form our team will contact you