Why Skills-First Leadership Is Replacing the Ivy League Playbook in the C-Suite

The old prestige pyramid—where Ivy League degrees and blue-chip consulting backgrounds paved the way to the CEO seat—is cracking.

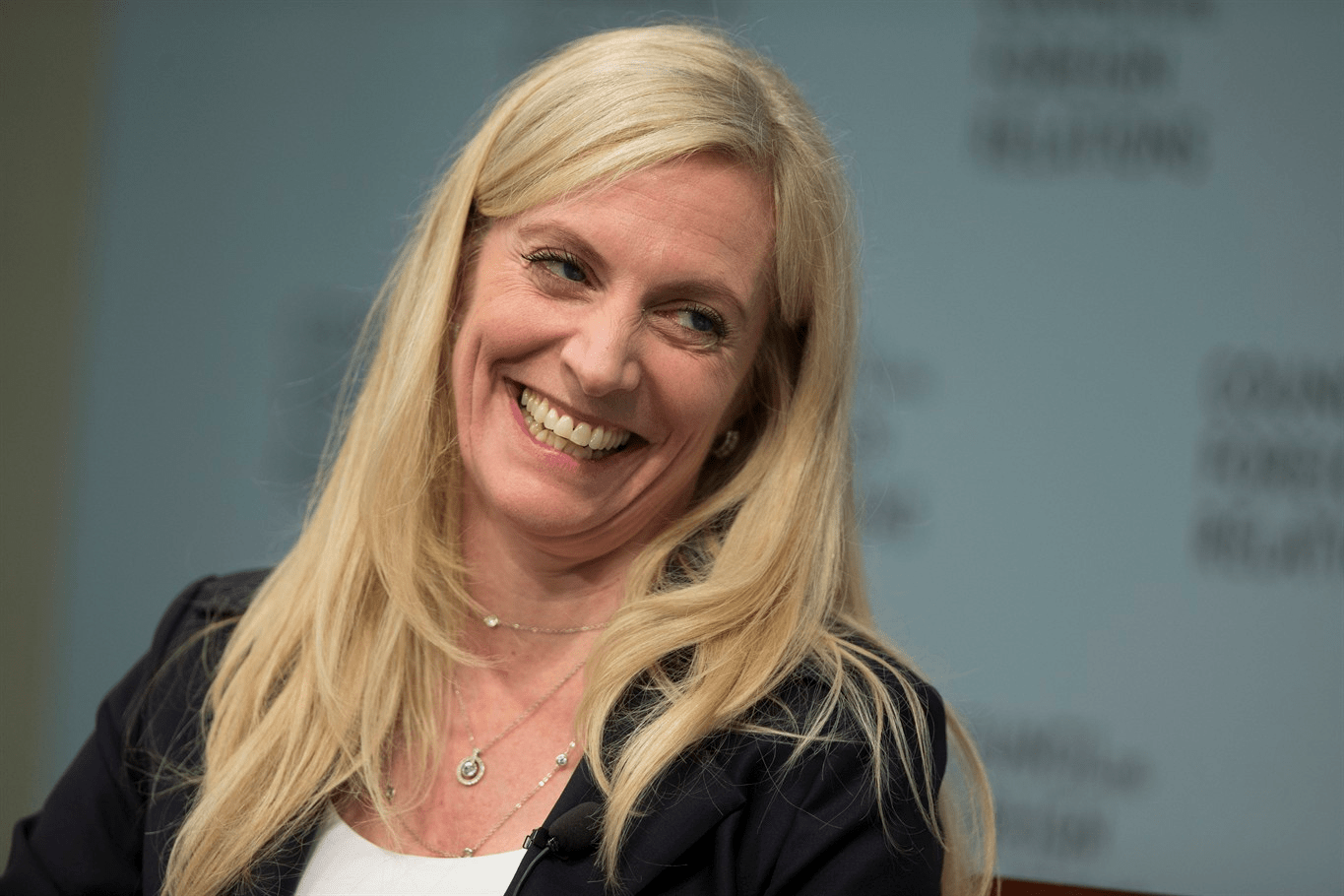

May 25, 2021: -On Monday, Federal Reserve Governor Lael Brainard pressed the case for a digital dollar, saying that a cryptocurrency backed by the central bank provides various benefits.

Providing financial services to the around 1 in 5 Americans considered “underbanked” is one of Brainard’s advantages cited in a speech to a conference which is presented by Coindesk.

She cited the safety of a Fed-backed system and the improvements in efficiency and cross-border payments amid the people in other different countries.

While stressing the value of moving forward carefully, Brainard said the Covid-19 pandemic strengthened the system in which a broad swath of the public can access well-regulated digital money.

“The Federal Reserve is committed to ensuring that the public has access to safe, reliable, and secure means of payment, that include cash,” she said.

“As part of this commitment, we must explore the extent to which households’ and businesses’ needs and preferences may migrate to digital payments over time,” she added.

Those comments came after Fed Chairman Jerome Powell announces that the central bank would be releasing a working paper that addresses many issues that involve Central Bank Digital Currencies.

The Boston Fed and MIT have launched a joint project to set up a hypothetical model, and several other Fed districts are also involved with research of their own.

When Congress began sending relief payments initially, some individuals didn’t get theirs for weeks because they either did not have accounts or their information was not updated with the IRS, she added.

“In the United States, the pandemic led to an acceleration of the migration to digital payments as well as increased demand for cash,” Brainard said in prepared remarks. “While the use of cash spiked at certain times, there was a pronounced shift by consumers and businesses to contactless transactions facilitated by electronic payments.”

Without naming specific cryptocurrencies, Brainard noted that alternate payment systems present multiple problems, including potential fraud.

“In contrast, a digital dollar would be a new type of central bank money issued in digital form for use by the general public,” she said.

The Fed has not set a timetable for its currency. The FedNow Service, which would be a payments system that in some ways would resemble a digital dollar, is expected to come in line in two years.

The old prestige pyramid—where Ivy League degrees and blue-chip consulting backgrounds paved the way to the CEO seat—is cracking.

Loud leaders once ruled the boardroom. Charisma was currency. Big talk drove big valuations.

But the CEOs who make history in downturns aren’t the ones with the deepest cuts

Companies invest millions in leadership development, yet many of their best executives leave within a few years. Why?

The most successful business leaders don’t just identify gaps in the market; they anticipate future needs before anyone else.

With technological advancements, shifting consumer expectations, and global interconnectedness, the role of business leaders

At seventeen, Professor Richard Rose stepped into a world few adults dare to navigate: the world of children fractured by trauma. He wasn’t a clinician then, nor a scholar. He was simply a young man with a heart tuned to the quiet ache of others.

Following a distinguished Law Enforcement career Joe McGee founded The Securitatem Group to provide contemporary global operational specialist security and specialist security training products and services for private clients, corporate organisations, and Government bodies. They deliver a wide range of services, including complete end-to-end protection packages, close protection, residential security, protection drivers, and online and physical installations. They provide covert and overt investigations and specialist surveillance services with a Broad range of weapons and tactical-based training, including conflict management, risk and threat management, tactical training, tactical medicine, and command and control training.

Jay Wright, CEO and Co-Owner of Virgin Wines infectious energy, enthusiasm, passion and drive has been instrumental in creating an environment that encourages talent to thrive and a culture that puts the customer at the very heart of every decision-making process.

Fabio de Concilio is the visionary CEO & Chairman of the Board at Farmacosmo, a leading organization dedicated to mental health and community support services. With a deep commitment to identifying and meeting customer needs, Fabio ensures that high standards are maintained across the board.

Leave us a message

Subscribe

Fill the form our team will contact you

Advertise with us

Fill the form our team will contact you