Why Skills-First Leadership Is Replacing the Ivy League Playbook in the C-Suite

The old prestige pyramid—where Ivy League degrees and blue-chip consulting backgrounds paved the way to the CEO seat—is cracking.

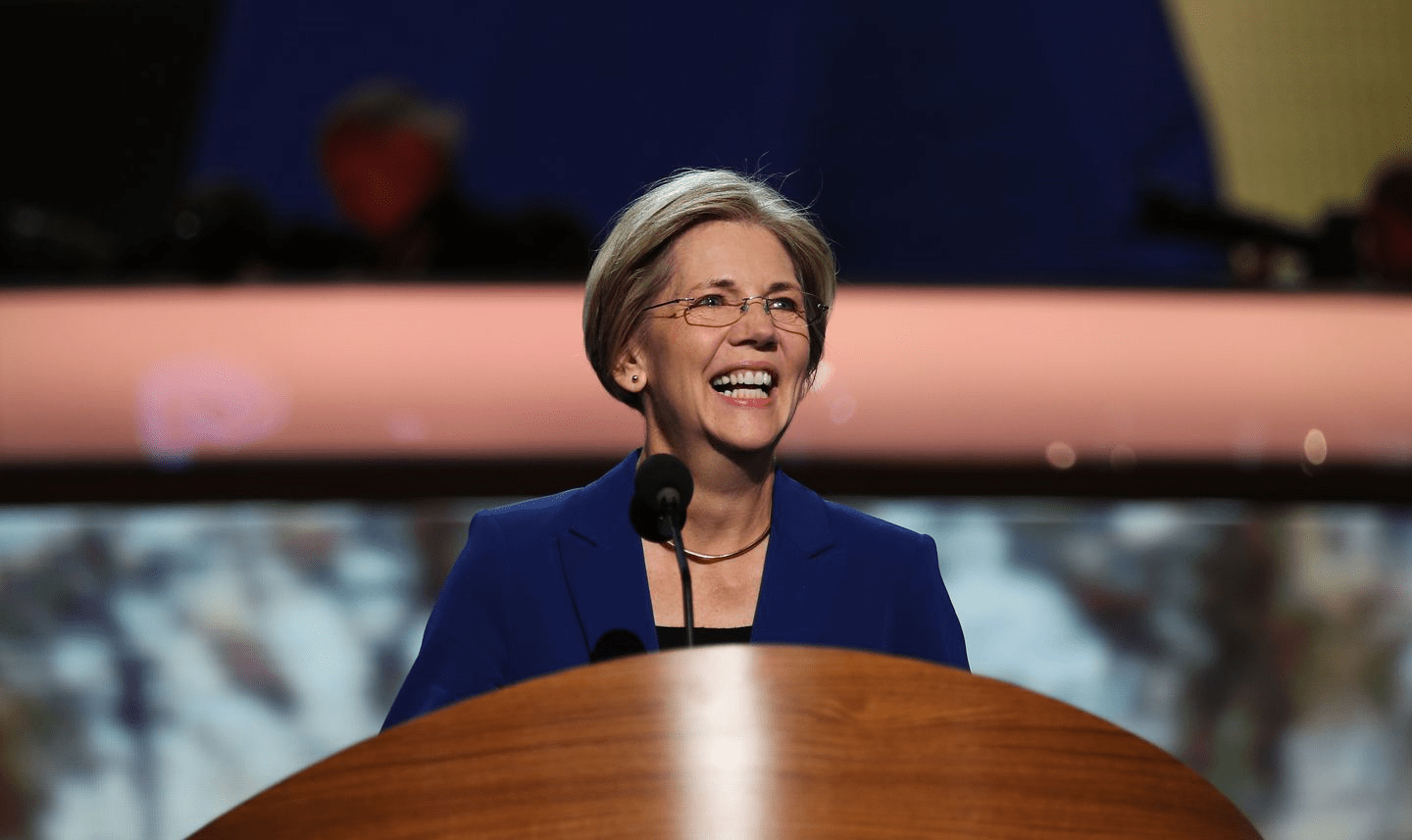

April 28, 2021: – On Tuesday, Sen. Elizabeth Warren aimed at FedEx, Nike, and Amazon as she championed the need to raise taxes on corporations and the richest Americans.

In an interview with CNBC’s “Squawk Box,” the Massachusetts progressive senator blasted the three corporate giants while describing why corporations should get hit with a higher tax rate specifically.

“What’s happening right now in America is these small businesses pay their taxes at the full rate. They got to pay the whole thing,” Warren said.

Warren argued that big corporations’ lower tax bills hurt small businesses by knocking them out of the competition.

Warren’s new criticism of corporate giants comes as Joe Biden and Democrats are looking to increase the corporate tax rate to 28% from 21% to help pay for a $2 trillion package of infrastructure.

One of Warren’s new battles has been with billionaire Leon Cooperman, who she invited to attend a Senate Finance Committee hearing meant to focus on her proposed millionaires’ tax. He declined to participate in the hearing on Tuesday.

FedEx and Nike were mentioned in an April report by the Institute on Taxation and Economic Policy as companies that recently paid little-to-no federal corporate income taxes.

“The FedEx zeroed out its federal income tax on $1.2 billion of U.S. pretax income in 2020 and received a rebate of $230 million,” the report said. “The shoe manufacturer Nike didn’t pay a dime of federal income tax on almost $2.9 billion of U.S. pretax income last year, instead of enjoying a $109 million tax rebate.”

Regarding Amazon, the Institute on Taxation and Economic Policy estimated the e-commerce giant’s federal tax rate was just 9.4% in 2020. That’s well below the “statutory” rate of 21%.

Amazon has blamed Congress for the state of the tax code and pushed back the criticism. Meanwhile, CEO Jeff Bezos has said he supports an increase in the corporate tax rate.

Warren blamed the current tax code on corporate lobbyists such as those working for Amazon.

“How do you think the tax code ended up as it did? It ended up like it did because companies like Amazon sent armies of lawyers and lobbyists to craft every possible loophole that they would be able to use to pay nothing in taxes,” Warren said on Tuesday.

The old prestige pyramid—where Ivy League degrees and blue-chip consulting backgrounds paved the way to the CEO seat—is cracking.

Loud leaders once ruled the boardroom. Charisma was currency. Big talk drove big valuations.

But the CEOs who make history in downturns aren’t the ones with the deepest cuts

Companies invest millions in leadership development, yet many of their best executives leave within a few years. Why?

The most successful business leaders don’t just identify gaps in the market; they anticipate future needs before anyone else.

With technological advancements, shifting consumer expectations, and global interconnectedness, the role of business leaders

The Fort McMurray First Nation Group of Companies is the wholly owned business entity of Fort McMurray 468 First Nation. It was established in 1987 as Christina River Enterprises, and the organization rebranded as FMFN Group in 2021. Providing Construction, Custodial, Petro-Canada Fuel & Convenience Store, and Transportation services to a broad portfolio of customers, the Group of Companies is creating financial stability and prosperity for the Nation.

Maushum Basu is a visionary leader who inspires his team with a clear, compelling purpose. Unafraid to take calculated risks, he understands that growth often stems from change and innovation. His deep commitment to both Airia Brands, Inc.

When speaking with Martin Paquette, one thing is immediately apparent: he’s honest. His transparency is refreshing. While many shy away from such vulnerability, Paquette sees it as a force to reckon with. The incredible emotional intelligence speaks to years of looking within—it’s also what allows him to acknowledge his mistakes gracefully and use them as opportunities to innovate.

Marina Charriere, CEO of Star Drug Testing Services, Star Drug Testing Services (Windsor Park), and First Defence Face Masks go hand in hand. Star is a drug and alcohol testing facility, and First D F M is a face mask company.

Leave us a message

Subscribe

Fill the form our team will contact you

Advertise with us

Fill the form our team will contact you