Why Skills-First Leadership Is Replacing the Ivy League Playbook in the C-Suite

The old prestige pyramid—where Ivy League degrees and blue-chip consulting backgrounds paved the way to the CEO seat—is cracking.

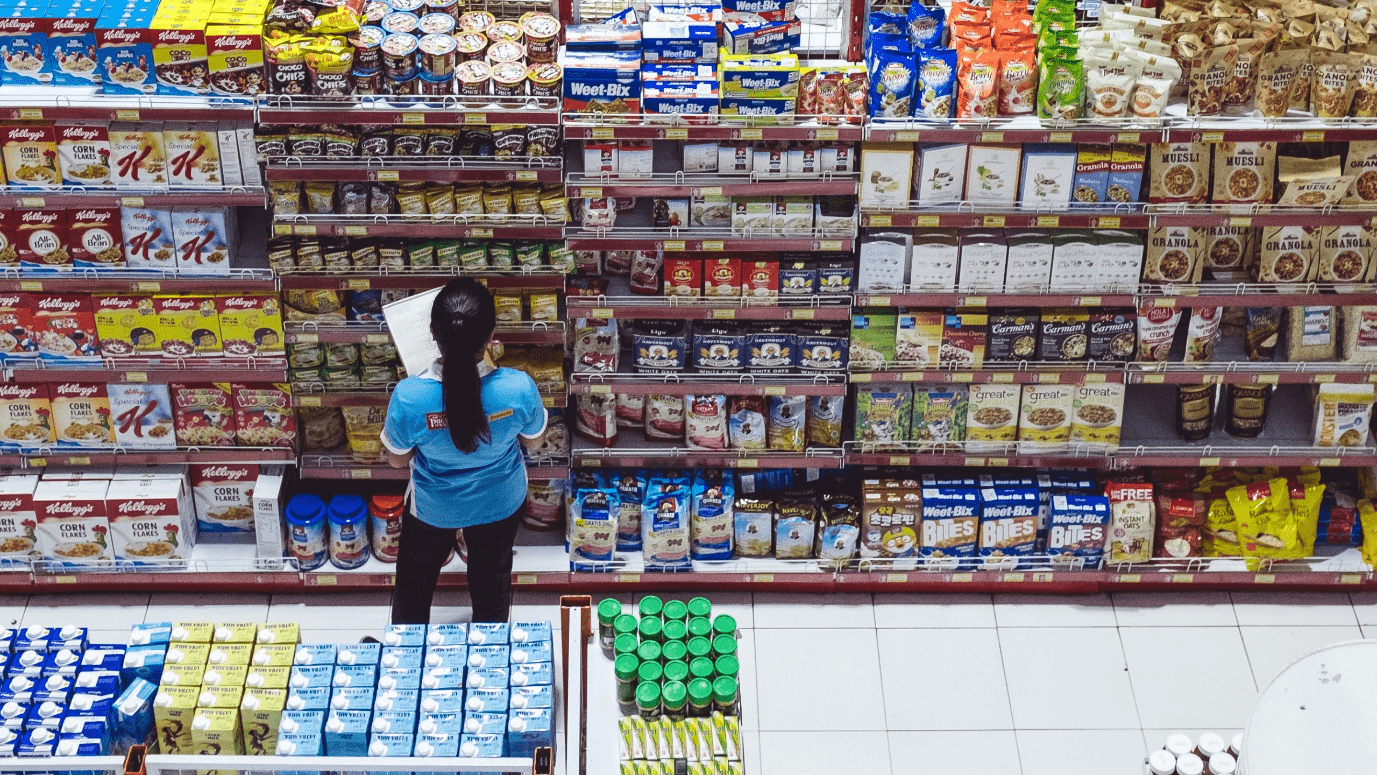

October 15, 2021: -On Wednesday, Consumer prices increased slightly over expected in September as food and energy price increases offset declines in used cars, the Labor Department reported.

The consumer price index for all items increased 0.4% for the month, compared with the 0.3% Dow Jones estimate. On a year-by-year basis, prices increased 5.4% versus the forecast for 5.3% and the highest since January 1991.

Although, excluding volatile food and energy prices, the CPI increased 0.2% on the month and 4% for a year, against respective estimates for 0.3% and 4%.

Dow futures were positive following the news but decreased sharply through the morning, while government bond yields were lower as investors gravitated toward safe-haven fixed income.

Gasoline prices surged another 1.2% for the month, bringing the annual surge to 42.1%. Fuel oil shot up 3.9%, for a 42.6% year-over-year surge.

Food prices showed notable gains for the month, with food at home increasing by 1.2%. Meat prices increased 3.3% and increased 12.6% year over year.

“Food and energy are more variable, but that’s where the problem is,” said Bob Doll, chief investment officer at Crossmark Global Investments. “Hopefully, solving our supply shortage problem. But when the dust settles, inflation is not going back to zero to 2 where it was for the last decade.”

Airline fares were 6.4% for the month after falling 9.1% in July.

Shelter prices, which make up about a third of the CPI, surged 0.4% for the month and are up 3.2% for the 12 months. Owners’ equivalent rent, or how much an owner of a property would have to pay to rent it, increased 0.4%, too, it’s most significant monthly gain since June 2006.

Apparel prices also declined 1.1% in September, while transportation services dropped 0.5%. Both sectors have been increasing consistently and still showed respective annual gains of 3.4% and 4.4%.

Federal Reserve officials have called the current inflation run “transitory” and attribute it primarily to supply chain and demand issues that they expect to subside in the months ahead.

However, that view has been receiving substantial pushback lately.

“This is one more data point to say, ‘Fed, you’re trying to convince us that inflation is transitory is just not believable,'” Doll said. “If you know anybody who doesn’t have to live somewhere, doesn’t eat any food, and doesn’t use energy, then inflation is maybe not a particular problem. But come on.”

The old prestige pyramid—where Ivy League degrees and blue-chip consulting backgrounds paved the way to the CEO seat—is cracking.

Loud leaders once ruled the boardroom. Charisma was currency. Big talk drove big valuations.

But the CEOs who make history in downturns aren’t the ones with the deepest cuts

Companies invest millions in leadership development, yet many of their best executives leave within a few years. Why?

The most successful business leaders don’t just identify gaps in the market; they anticipate future needs before anyone else.

With technological advancements, shifting consumer expectations, and global interconnectedness, the role of business leaders

The Fort McMurray First Nation Group of Companies is the wholly owned business entity of Fort McMurray 468 First Nation. It was established in 1987 as Christina River Enterprises, and the organization rebranded as FMFN Group in 2021. Providing Construction, Custodial, Petro-Canada Fuel & Convenience Store, and Transportation services to a broad portfolio of customers, the Group of Companies is creating financial stability and prosperity for the Nation.

Maushum Basu is a visionary leader who inspires his team with a clear, compelling purpose. Unafraid to take calculated risks, he understands that growth often stems from change and innovation. His deep commitment to both Airia Brands, Inc.

When speaking with Martin Paquette, one thing is immediately apparent: he’s honest. His transparency is refreshing. While many shy away from such vulnerability, Paquette sees it as a force to reckon with. The incredible emotional intelligence speaks to years of looking within—it’s also what allows him to acknowledge his mistakes gracefully and use them as opportunities to innovate.

Marina Charriere, CEO of Star Drug Testing Services, Star Drug Testing Services (Windsor Park), and First Defence Face Masks go hand in hand. Star is a drug and alcohol testing facility, and First D F M is a face mask company.

Leave us a message

Subscribe

Fill the form our team will contact you

Advertise with us

Fill the form our team will contact you