Why Skills-First Leadership Is Replacing the Ivy League Playbook in the C-Suite

The old prestige pyramid—where Ivy League degrees and blue-chip consulting backgrounds paved the way to the CEO seat—is cracking.

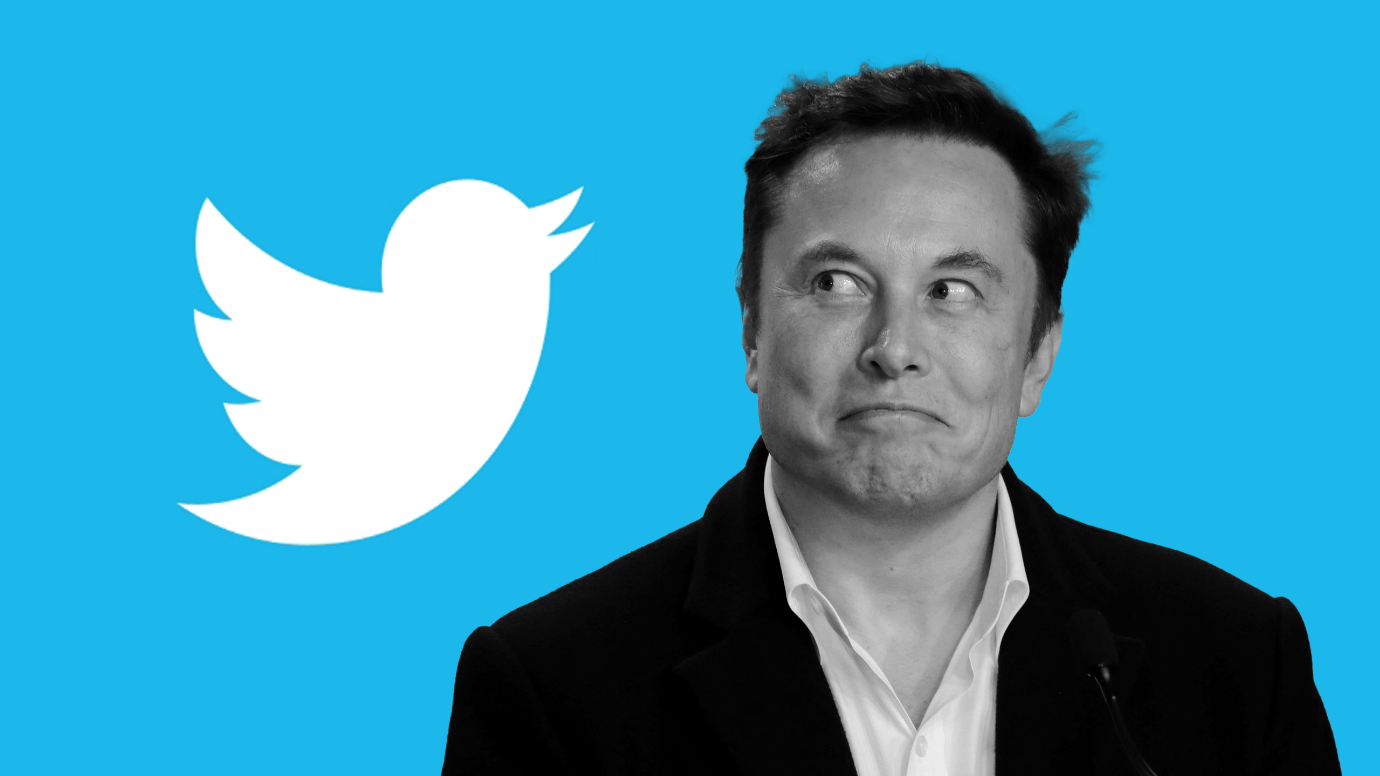

July 14, 2022: -On Tuesday, Twitter filed suit against Elon Musk in the Delaware Court of Chancery after the billionaire said he was ending his $44 billion deal to buy the company.

After entering a binding merger agreement, Twitter said Musk “refuses to honor his obligations to Twitter and its stockholders as the deal he signed no longer serves his interests.”

Twitter’s suit had to come after Musk said that he no longer plans to buy the social network, which cited Twitter bots and claimed that the company didn’t give him the information he was expecting to evaluate the deal.

Tuesday’s lawsuit marks the start of a protracted legal battle as Twitter is willing to hold Musk to his deal to pay $54.20 for each share for the company, and Musk wants to let out of the agreement.

The outcome of the dispute is unpredictable. It could involve a judge who forces Musk to complete the deal or forces him to pay a $1 billion breakup fee, or other scenarios including a settlement, renegotiation of the purchase price, or even Musk walking away without paying anything.

According to a court filing, Twitter seeks a four-day trial in September.

On Tuesday, Twitter argued that Musk’s conduct in his pursuit of the social network was in “bad faith” and blamed the Tesla CEO for acting against the deal from the “market started turning.”

“Having mounted a public spectacle putting Twitter in play and having proposed and then signed a seller-friendly merger agreement, Musk believes that he is free to change his mind, trash the company, disrupt its operations, destroy stockholder value, and walk away,” Twitter said.

“This repudiation is following a long list of material contractual breaches by Musk that have cast a pall more than Twitter and its business,” Twitter wrote in its suit.

The suit claims that what Musk says about why he is willing to terminate the deal, which includes the prevalence of bots on the service, are “pretexts.”

Musk announced plans to buy Twitter for $54.20 per share in April. The stock was trading at just over $34 per share at Tuesday’s close, over 37% lower than Musk’s offer.

Twitter attributes the decline partially to Musk’s actions, although other social media companies have also seen their share prices increase during a similar period.

The old prestige pyramid—where Ivy League degrees and blue-chip consulting backgrounds paved the way to the CEO seat—is cracking.

Loud leaders once ruled the boardroom. Charisma was currency. Big talk drove big valuations.

But the CEOs who make history in downturns aren’t the ones with the deepest cuts

Companies invest millions in leadership development, yet many of their best executives leave within a few years. Why?

The most successful business leaders don’t just identify gaps in the market; they anticipate future needs before anyone else.

With technological advancements, shifting consumer expectations, and global interconnectedness, the role of business leaders

Following a distinguished Law Enforcement career Joe McGee founded The Securitatem Group to provide contemporary global operational specialist security and specialist security training products and services for private clients, corporate organisations, and Government bodies. They deliver a wide range of services, including complete end-to-end protection packages, close protection, residential security, protection drivers, and online and physical installations. They provide covert and overt investigations and specialist surveillance services with a Broad range of weapons and tactical-based training, including conflict management, risk and threat management, tactical training, tactical medicine, and command and control training.

Jay Wright, CEO and Co-Owner of Virgin Wines infectious energy, enthusiasm, passion and drive has been instrumental in creating an environment that encourages talent to thrive and a culture that puts the customer at the very heart of every decision-making process.

Fabio de Concilio is the visionary CEO & Chairman of the Board at Farmacosmo, a leading organization dedicated to mental health and community support services. With a deep commitment to identifying and meeting customer needs, Fabio ensures that high standards are maintained across the board.

Character Determines Destiny – so said Aristotle. And David CM Carter believes that more than anything else. For David, it has been numerous years of research into codifying Entelechy Academy’s 54 character qualities that underpin everything he stands for as a leader and teacher.

Leave us a message

Subscribe

Fill the form our team will contact you

Advertise with us

Fill the form our team will contact you