Why Skills-First Leadership Is Replacing the Ivy League Playbook in the C-Suite

The old prestige pyramid—where Ivy League degrees and blue-chip consulting backgrounds paved the way to the CEO seat—is cracking.

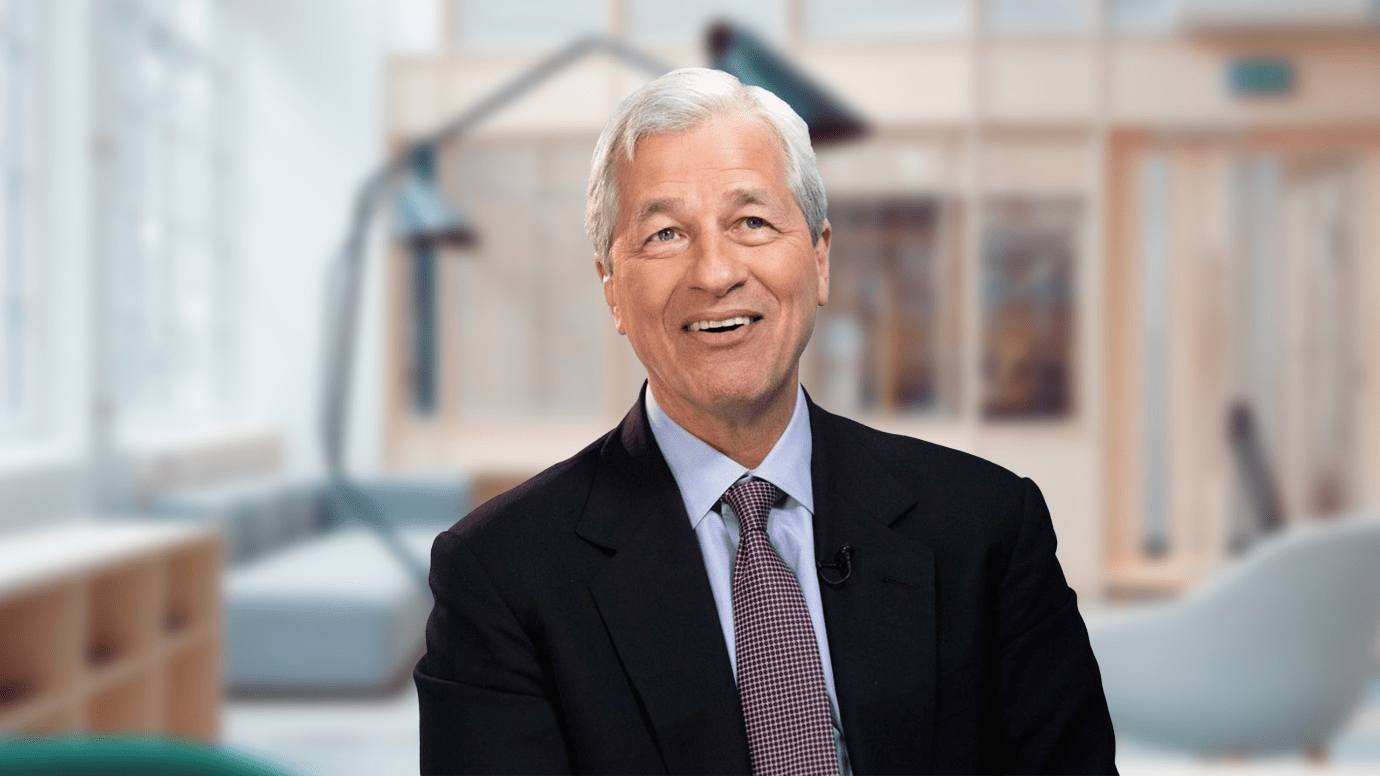

April 5, 2022: -Jamie Dimon, CEO and chairman of the biggest U.S. bank by assets, pointed to a potentially unprecedented combination of risks facing the country in his annual shareholder letter.

Three forces have shaped the world over several decades: a U.S. economy rebounding from the Covid pandemic, high inflation that will usher in an era of increasing rates, Russia’s invasion of Ukraine, and the resultant humanitarian crisis underway, according to Dimon.

“Each of these three factors mentioned above is unique in its own right. Dimon wrote about the dramatic stimulus-fueled recovery from the COVID-19 pandemic, the need for rapidly raised rates and the required reversal of QE, the war in Ukraine, and the sanctions on Russia,” Dimon wrote.

“They present different circumstances than what we’ve experienced in the past, and confluence may dramatically increase the risks ahead,” he wrote. “While it is possible and hopeful that these events will have peaceful resolutions, we should prepare for the potential negative outcomes.”

Dimon’s letter, read widely in business circles due to the JPMorgan CEO’s status as his industry’s most prominent spokesman, took a more melancholy tone from his message last year. While he wrote extensively about the country’s challenges, which include economic inequality and political dysfunction, that letter broadcast his belief that the U.S. was in the midst of a boom that could “easily” run into 2023.

Now, however, he wrote that the outbreak of the most significant European conflict since World War II had changed things, roiling markets, realigning alliances, and restructuring global trade patterns. According to Dimon, that introduces both risks and opportunities for the U.S. and other democracies.

“The war in Ukraine and the sanctions on Russia, at a minimum, will slow the global economy, and it could easily get worse,” Dimon wrote. That’s due to the uncertainty about how the conflict will conclude and its impact on supply chains, especially energy supplies.

Dimon added that management isn’t worried about its direct exposure to Russia for JPMorgan, though the bank could “still lose about $1 billion over time.”

The old prestige pyramid—where Ivy League degrees and blue-chip consulting backgrounds paved the way to the CEO seat—is cracking.

Loud leaders once ruled the boardroom. Charisma was currency. Big talk drove big valuations.

But the CEOs who make history in downturns aren’t the ones with the deepest cuts

Companies invest millions in leadership development, yet many of their best executives leave within a few years. Why?

The most successful business leaders don’t just identify gaps in the market; they anticipate future needs before anyone else.

With technological advancements, shifting consumer expectations, and global interconnectedness, the role of business leaders

Following a distinguished Law Enforcement career Joe McGee founded The Securitatem Group to provide contemporary global operational specialist security and specialist security training products and services for private clients, corporate organisations, and Government bodies. They deliver a wide range of services, including complete end-to-end protection packages, close protection, residential security, protection drivers, and online and physical installations. They provide covert and overt investigations and specialist surveillance services with a Broad range of weapons and tactical-based training, including conflict management, risk and threat management, tactical training, tactical medicine, and command and control training.

Jay Wright, CEO and Co-Owner of Virgin Wines infectious energy, enthusiasm, passion and drive has been instrumental in creating an environment that encourages talent to thrive and a culture that puts the customer at the very heart of every decision-making process.

Fabio de Concilio is the visionary CEO & Chairman of the Board at Farmacosmo, a leading organization dedicated to mental health and community support services. With a deep commitment to identifying and meeting customer needs, Fabio ensures that high standards are maintained across the board.

Character Determines Destiny – so said Aristotle. And David CM Carter believes that more than anything else. For David, it has been numerous years of research into codifying Entelechy Academy’s 54 character qualities that underpin everything he stands for as a leader and teacher.

Leave us a message

Subscribe

Fill the form our team will contact you

Advertise with us

Fill the form our team will contact you