Why Skills-First Leadership Is Replacing the Ivy League Playbook in the C-Suite

The old prestige pyramid—where Ivy League degrees and blue-chip consulting backgrounds paved the way to the CEO seat—is cracking.

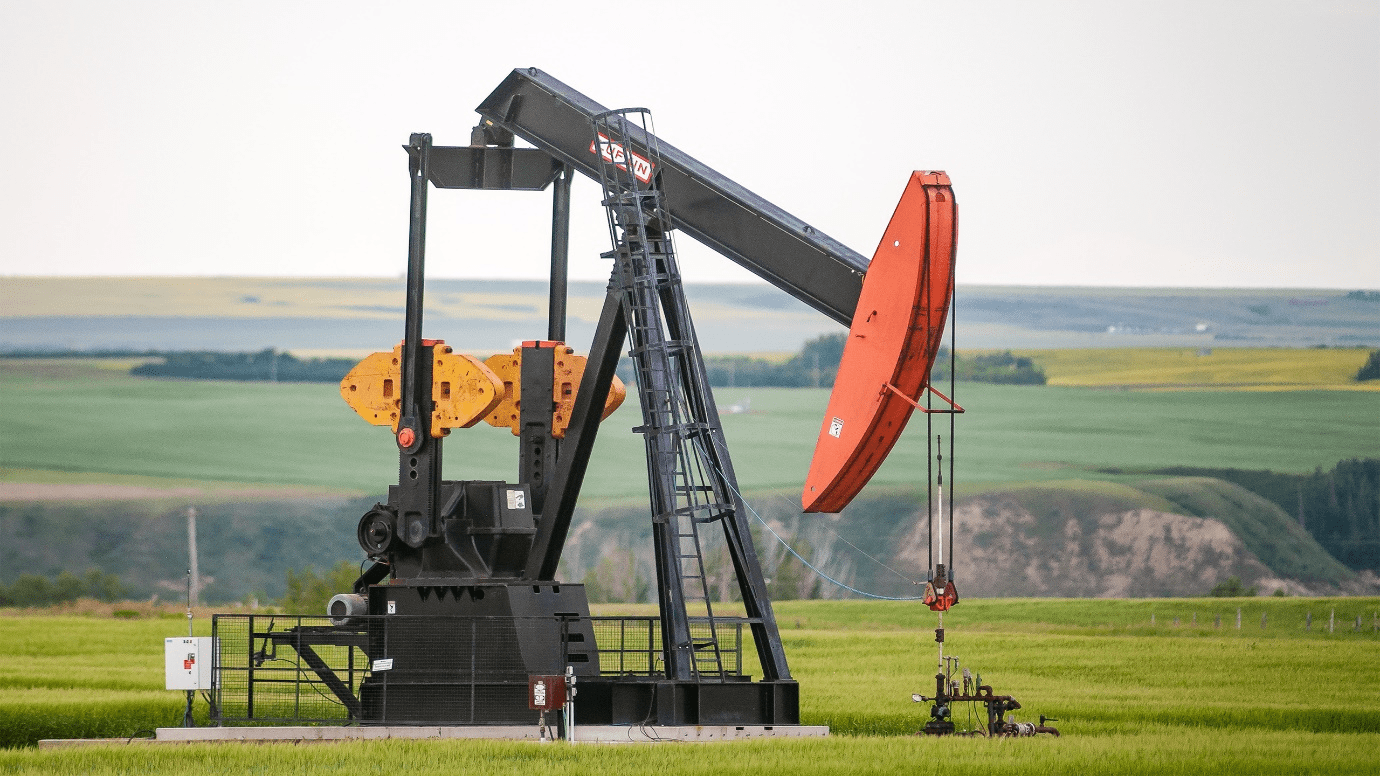

March 18, 2022: On Tuesday, Oil registered heavy losses, building on Monday’s decline, as myriad factors weighed on sentiment, including talks between Russia and Ukraine, a potential slowdown in Chinese demand, and the unwinding of trades ahead of the Federal Reserve’s expected rate hike Wednesday.

Both West Texas Intermediate crude, the U.S. oil benchmark, and global benchmark Brent crude settled below $100 per barrel Tuesday, a far cry from the more than $130 they fetched just over a week ago.

Brent settled 6.54% lower at $99.91 per barrel after trading as low as $97.44. During the session, it traded as low as $93.53. WTI ended the day at $96.44, for a loss of 6.38%.

WTI and Brent fell 5.78% and 5.12%, respectively, on Monday.

“Growth concerns from the Ukraine-Russia stagflation wave, and FOMC hike this week, and hopes that progress will be made in Ukraine-Russia negotiations” are weighing on prices, said Jeffrey Halley, senior market analyst at Oanda. “It seems like the adage that the best cure for high prices, is high prices, is as strong as ever,” he added, noting that he believes the top is in for oil prices.

Crude surged above $100 per barrel for the first time in years when Russia invaded Ukraine, and prices continued to climb as the conflict intensified.

WTI hit a high of $130.50 a barrel early in the previous week, while Brent traded as high as $139.26 per barrel. Prices jumped as traders feared that Russia’s energy exports would be disrupted. So far, the U.S. and Canada have banned Russian energy imports, while the U.K. has said it will phase out substances from the country.

But other nations in Europe, which are dependent on Russia’s oil and gas, have not enacted similar moves.

“It’s a market that traded entirely on fear,” Rebecca Babin, a senior energy trader at CIBC Private Wealth U.S., said of the initial spike higher amid supply fears. “Now, without a true change in the facts, we’re trading on the hope” that things won’t be as bad in the commodity market as initially feared.

“We don’t have a lot of clarity around what is going to happen with crude supplies in the future as a result of this conflict,” she added.

While self-sanctioning has happened to a certain extent, experts say Russian energy is still finding buyers, including India.

China’s latest moves to curb the spread of Covid-19 are also having an impact on prices. The nation is the world’s largest oil importer, so any slowdown in demand will hit prices.

The old prestige pyramid—where Ivy League degrees and blue-chip consulting backgrounds paved the way to the CEO seat—is cracking.

Loud leaders once ruled the boardroom. Charisma was currency. Big talk drove big valuations.

But the CEOs who make history in downturns aren’t the ones with the deepest cuts

Companies invest millions in leadership development, yet many of their best executives leave within a few years. Why?

The most successful business leaders don’t just identify gaps in the market; they anticipate future needs before anyone else.

With technological advancements, shifting consumer expectations, and global interconnectedness, the role of business leaders

Following a distinguished Law Enforcement career Joe McGee founded The Securitatem Group to provide contemporary global operational specialist security and specialist security training products and services for private clients, corporate organisations, and Government bodies. They deliver a wide range of services, including complete end-to-end protection packages, close protection, residential security, protection drivers, and online and physical installations. They provide covert and overt investigations and specialist surveillance services with a Broad range of weapons and tactical-based training, including conflict management, risk and threat management, tactical training, tactical medicine, and command and control training.

Jay Wright, CEO and Co-Owner of Virgin Wines infectious energy, enthusiasm, passion and drive has been instrumental in creating an environment that encourages talent to thrive and a culture that puts the customer at the very heart of every decision-making process.

Fabio de Concilio is the visionary CEO & Chairman of the Board at Farmacosmo, a leading organization dedicated to mental health and community support services. With a deep commitment to identifying and meeting customer needs, Fabio ensures that high standards are maintained across the board.

Character Determines Destiny – so said Aristotle. And David CM Carter believes that more than anything else. For David, it has been numerous years of research into codifying Entelechy Academy’s 54 character qualities that underpin everything he stands for as a leader and teacher.

Leave us a message

Subscribe

Fill the form our team will contact you

Advertise with us

Fill the form our team will contact you