Why Skills-First Leadership Is Replacing the Ivy League Playbook in the C-Suite

The old prestige pyramid—where Ivy League degrees and blue-chip consulting backgrounds paved the way to the CEO seat—is cracking.

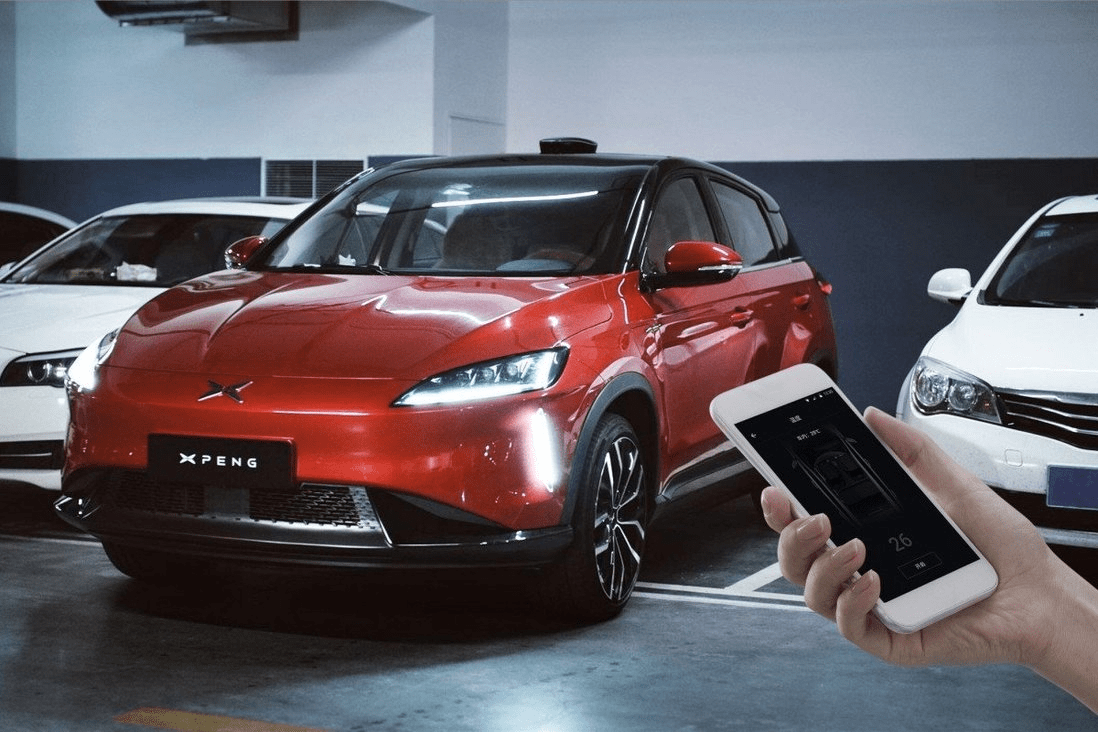

July 8, 2021: -Shares of U.S.-listed electric vehicle maker Xpeng closed flat on Wednesday in their Hong Kong debut.

Xpeng is issuing 85 million Class A ordinary shares for 165 Hong Kong dollars each. The shares opened at 168 Hong Kong dollars, a 1.8% increase. Shortly after, they turned hostile and ended the day flat at 165 Hong Kong dollars.

The electric carmaker is usually listed in the U.S. Usually, Chinese companies listed on Wall Street will do the secondary listing, usually in Hong Kong. This is the company listed on one exchange goes on to sell shares on another.

But Xpeng’s share offering is a dual-primary listing. Meaning it will be subject to the rules and oversight of the U.S. and Hong Kong regulators, which is not the idea with a secondary listing.

Last month, the electric carmaker said that it would price shares at no more than 180 Hong Kong dollars each. Xpeng increased gross proceeds by 14.02 billion Hong Kong dollars.

In Hong Kong, the U.S.-listed Chinese companies have looked to list as a way to hedge against tensions amid China and the United States.

This year, the U.S. Securities and Exchange Commission adopt the rules that impose stricter audit requirements on foreign firms listed in the U.S. Those requirements get the threat of delisting for companies that run afoul of the rules.

“I would say our Hong Kong listing is a very strategic decision. In it, I think, you know, hedging against geopolitical risks is only one of the considerations,” Brian Gu, president of Xpeng, told CNBC.

“But in the long run, though, we would like to have a listing venue that gets us closer to home because we’re a consumer brand in China. Ultimately we want our customers to be our shareholders, and having the dual primary that list status in Hong Kong will give the eligibility to be connected to Chinese capital markets.”

But Chinese firms listed in the U.S. can also face scrutiny at home. Beijing said, on Tuesday, it would step up the supervision of companies listed overseas. The government is planning to improve rules around cross-border data flows and security. The move came after regulators launched a cybersecurity review into ride-hailing company Didi and forced app stores to remove it from download after its U.S. initial public offering.

The carmaker launched its third production model, in April, the P5 sedan, as competition ramps up with Li Auto, Tesla, and Nio.

The old prestige pyramid—where Ivy League degrees and blue-chip consulting backgrounds paved the way to the CEO seat—is cracking.

Loud leaders once ruled the boardroom. Charisma was currency. Big talk drove big valuations.

But the CEOs who make history in downturns aren’t the ones with the deepest cuts

Companies invest millions in leadership development, yet many of their best executives leave within a few years. Why?

The most successful business leaders don’t just identify gaps in the market; they anticipate future needs before anyone else.

With technological advancements, shifting consumer expectations, and global interconnectedness, the role of business leaders

At seventeen, Professor Richard Rose stepped into a world few adults dare to navigate: the world of children fractured by trauma. He wasn’t a clinician then, nor a scholar. He was simply a young man with a heart tuned to the quiet ache of others.

Following a distinguished Law Enforcement career Joe McGee founded The Securitatem Group to provide contemporary global operational specialist security and specialist security training products and services for private clients, corporate organisations, and Government bodies. They deliver a wide range of services, including complete end-to-end protection packages, close protection, residential security, protection drivers, and online and physical installations. They provide covert and overt investigations and specialist surveillance services with a Broad range of weapons and tactical-based training, including conflict management, risk and threat management, tactical training, tactical medicine, and command and control training.

Jay Wright, CEO and Co-Owner of Virgin Wines infectious energy, enthusiasm, passion and drive has been instrumental in creating an environment that encourages talent to thrive and a culture that puts the customer at the very heart of every decision-making process.

Fabio de Concilio is the visionary CEO & Chairman of the Board at Farmacosmo, a leading organization dedicated to mental health and community support services. With a deep commitment to identifying and meeting customer needs, Fabio ensures that high standards are maintained across the board.

Leave us a message

Subscribe

Fill the form our team will contact you

Advertise with us

Fill the form our team will contact you