Why Skills-First Leadership Is Replacing the Ivy League Playbook in the C-Suite

The old prestige pyramid—where Ivy League degrees and blue-chip consulting backgrounds paved the way to the CEO seat—is cracking.

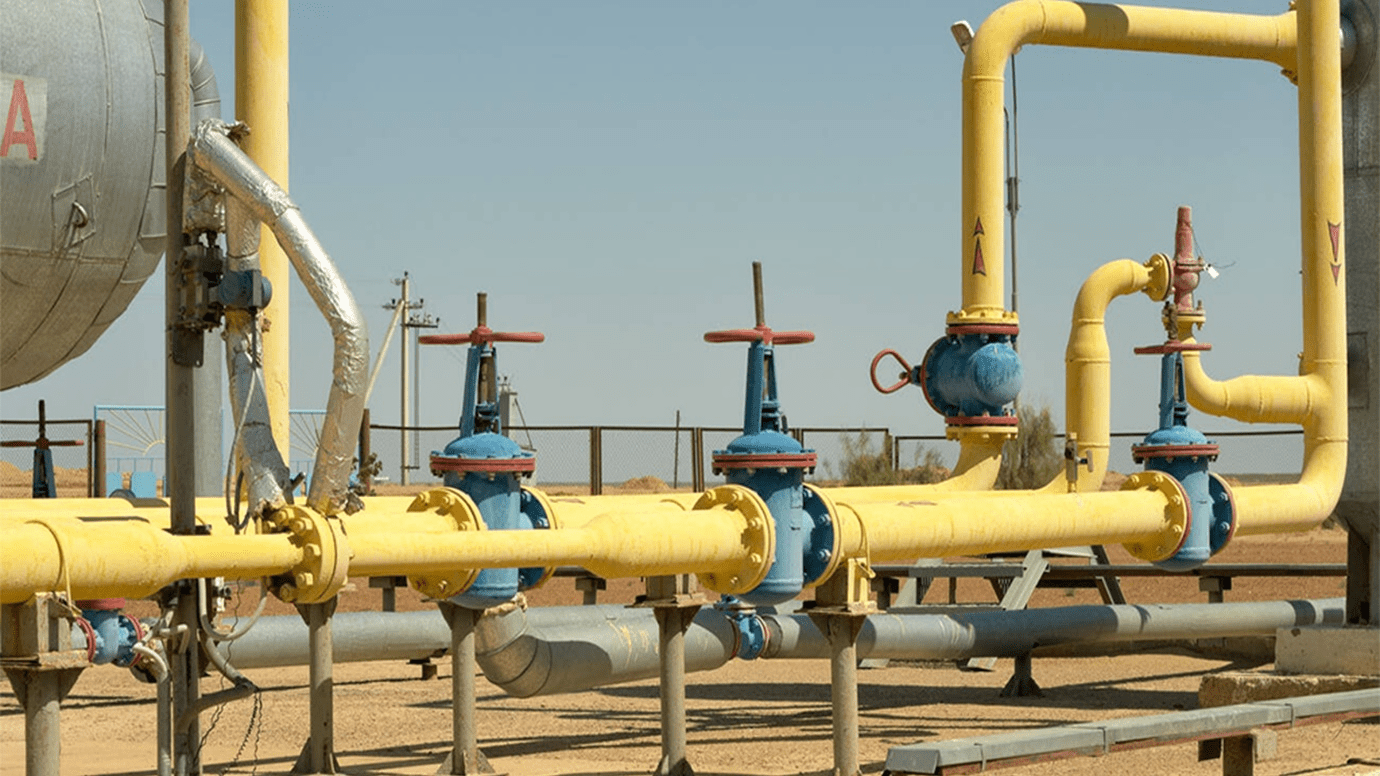

January 02, 2023: -This week, European natural gas prices decreased to decks not seen before Russia invaded Ukraine.

Front-month crude gas futures on the Dutch Title Transfer Facility, the European benchmark contract, tumbled in recent weeks to bottom out at less than 77 euros for every megawatt hour, a level not witnessed since February before the beginning of a full-scale war in Ukraine.

In August, their peak, European gas prices are topping 345 euros/MWh as Russia’s weaponization of its natural gas exporting to the rest of the continent as an answer to punitive EU sanctions and sky-high temperatures more than the summer getting up demand while constricting supply.

The spiking costs sent household energy bills soaring and have fueled a cost-of-living crisis throughout much of the continent.

Therefore, unseasonably warm weather through winter in much of northwest Europe has decreased demand for heating and is allowing the continent to replenish its gas inventory after the drawdowns during several cold snaps more than the last few months.

Goldman Sachs in November as an answer to a sharp decrease in European gas prices in the future as nations are gaining a temporary upper hand on supply issues.

“As a rule of thumb, a surge or decrease in gas prices by €100 per MWh changes the gas bill of the eurozone economy of GDP once households and purchases have to bear the complete costs of the change in gas prices,” Berenberg Chief Economist Holger Schmieding in a note last month.

“As the EU imports a few gases under longer-term fixed-price as an agreement, the actual impact on the gas import bill is as pronounced, but as electricity prices are still linked to gas costs, the total pain of high gas prices and the relief from any correction may be more giving than the rule of thumb suggests.”

The European Union, in the previous week, agreed upon a temporary mechanism to limit more than gas prices, coming into force on February 15.

The “market correction” mechanism triggers automatically if the front-month TTF price is more than 180 euros/MWh for three days and if it transfers by 35 euros from a reference price for global LNG over the same three days.

The old prestige pyramid—where Ivy League degrees and blue-chip consulting backgrounds paved the way to the CEO seat—is cracking.

Loud leaders once ruled the boardroom. Charisma was currency. Big talk drove big valuations.

But the CEOs who make history in downturns aren’t the ones with the deepest cuts

Companies invest millions in leadership development, yet many of their best executives leave within a few years. Why?

The most successful business leaders don’t just identify gaps in the market; they anticipate future needs before anyone else.

With technological advancements, shifting consumer expectations, and global interconnectedness, the role of business leaders

Following a distinguished Law Enforcement career Joe McGee founded The Securitatem Group to provide contemporary global operational specialist security and specialist security training products and services for private clients, corporate organisations, and Government bodies. They deliver a wide range of services, including complete end-to-end protection packages, close protection, residential security, protection drivers, and online and physical installations. They provide covert and overt investigations and specialist surveillance services with a Broad range of weapons and tactical-based training, including conflict management, risk and threat management, tactical training, tactical medicine, and command and control training.

Jay Wright, CEO and Co-Owner of Virgin Wines infectious energy, enthusiasm, passion and drive has been instrumental in creating an environment that encourages talent to thrive and a culture that puts the customer at the very heart of every decision-making process.

Fabio de Concilio is the visionary CEO & Chairman of the Board at Farmacosmo, a leading organization dedicated to mental health and community support services. With a deep commitment to identifying and meeting customer needs, Fabio ensures that high standards are maintained across the board.

Character Determines Destiny – so said Aristotle. And David CM Carter believes that more than anything else. For David, it has been numerous years of research into codifying Entelechy Academy’s 54 character qualities that underpin everything he stands for as a leader and teacher.

Leave us a message

Subscribe

Fill the form our team will contact you

Advertise with us

Fill the form our team will contact you