Why Skills-First Leadership Is Replacing the Ivy League Playbook in the C-Suite

The old prestige pyramid—where Ivy League degrees and blue-chip consulting backgrounds paved the way to the CEO seat—is cracking.

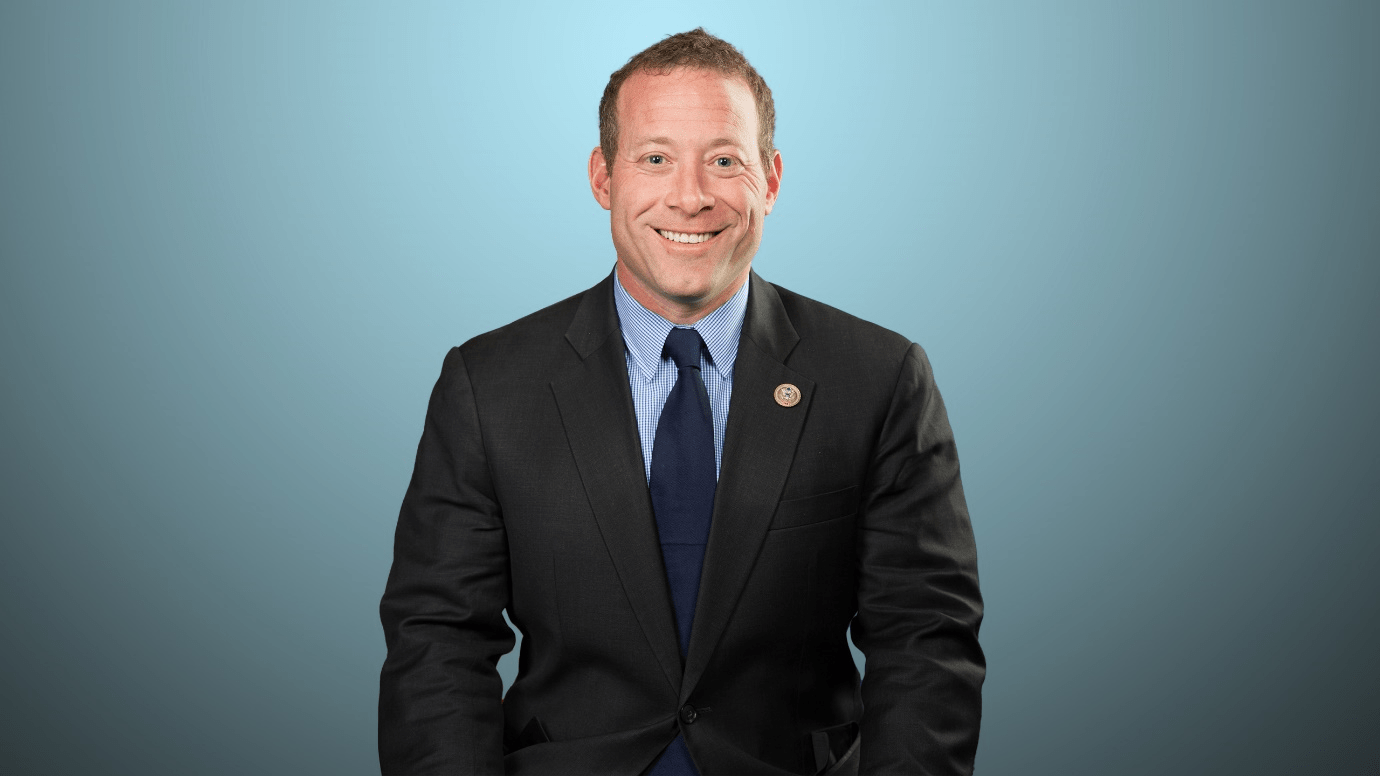

February 16, 2022: On Tuesday, New Jersey Rep. Josh Gottheimer unveiled an early draft of legislation aimed at placing definitions around stable coin, which critics consider susceptible to manipulation, bad actors, and collapse due to insufficient reserve capital.

On Monday, a discussion draft released by Gottheimer’s office proposes designing certain digital currencies as “qualified” stable coins if they can be redeemed on a one-for-one basis for U.S. dollars.

Qualified stablecoins could be issued either by a federally backed bank or a non-bank that agrees to maintain at least 100% reserve assets consisting of U.S. dollars, U.S. debt, or any other assets the Office of the Comptroller of the Currency deems appropriate cash collateral.

“I don’t think we should stifle innovation in the cryptocurrency market,” Gottheimer, a Democrat, said Monday afternoon.

Gottheimer’s legislation, which solicits input from Capitol Hill and the crypto industry, will likely be the first of the attempts to structure the new market from Congress and the Biden administration.

Gottheimer said Nellie Liang, an undersecretary of the Treasury who’s leading regulatory efforts, supported his plan when she appeared before the House Financial Services Committee last week.

“We’ve been very engaged with Treasury and Blockchain Association and many of the businesses in the space,” he added.

Stablecoins is, issued by companies like Tether and Circle Internet Financial, have erupted in popularity. Proponents said that stablecoins bridge the ease and speed of more-volatile cryptocurrencies with the stability of national currencies like the U.S. dollar.

While many stablecoin issuers keep a pool of dollars to back up the digital token’s value, it’s not always clear if they can guarantee 100% redemption requests for traditional fiat currencies. Few policymakers worry that a spike in redemption requests or a stable coin “run” could result in bankruptcy at the issuer and start a domino of insolvency.

“We welcome the leadership from Representative Gottheimer, taking a thoughtful, risk-based approach to stablecoin innovations in the U.S. and how they can fit inside Federal regulatory frameworks,” Dante Disparte, Circle’s chief strategy officer, said in a statement. “Supporting bank and non-bank innovations in the payment system is key to long-range competitiveness, and broad optionality for the way dollars move in the 21st century.”

Gottheimer’s bill comes as Washington attempts to define and regulate the crypto market.

In November, the Biden administration urged Congress to enact a litany of legislation and collaborate with other regulatory agencies to make sure stablecoins don’t pose a systemic risk.

Specifically, the President’s Working Group on Financial Markets suggested to restrict stablecoin issuance to banks insured by the Federal Deposit Insurance Corp. to ensure ongoing supervision, prudential standards, and access to the government’s safety net if required.

The old prestige pyramid—where Ivy League degrees and blue-chip consulting backgrounds paved the way to the CEO seat—is cracking.

Loud leaders once ruled the boardroom. Charisma was currency. Big talk drove big valuations.

But the CEOs who make history in downturns aren’t the ones with the deepest cuts

Companies invest millions in leadership development, yet many of their best executives leave within a few years. Why?

The most successful business leaders don’t just identify gaps in the market; they anticipate future needs before anyone else.

With technological advancements, shifting consumer expectations, and global interconnectedness, the role of business leaders

Maushum Basu is a visionary leader who inspires his team with a clear, compelling purpose. Unafraid to take calculated risks, he understands that growth often stems from change and innovation. His deep commitment to both Airia Brands, Inc.

When speaking with Martin Paquette, one thing is immediately apparent: he’s honest. His transparency is refreshing. While many shy away from such vulnerability, Paquette sees it as a force to reckon with. The incredible emotional intelligence speaks to years of looking within—it’s also what allows him to acknowledge his mistakes gracefully and use them as opportunities to innovate.

Marina Charriere, CEO of Star Drug Testing Services, Star Drug Testing Services (Windsor Park), and First Defence Face Masks go hand in hand. Star is a drug and alcohol testing facility, and First D F M is a face mask company.

Lejjy Gafour, CEO, CULT Food Science Corp. Lejjy is a self-taught entrepreneur and experienced company operator who made his start creating opportunities at the young age of 14, and he has been working, leading, and building businesses ever since.

Leave us a message

Subscribe

Fill the form our team will contact you

Advertise with us

Fill the form our team will contact you