Why Skills-First Leadership Is Replacing the Ivy League Playbook in the C-Suite

The old prestige pyramid—where Ivy League degrees and blue-chip consulting backgrounds paved the way to the CEO seat—is cracking.

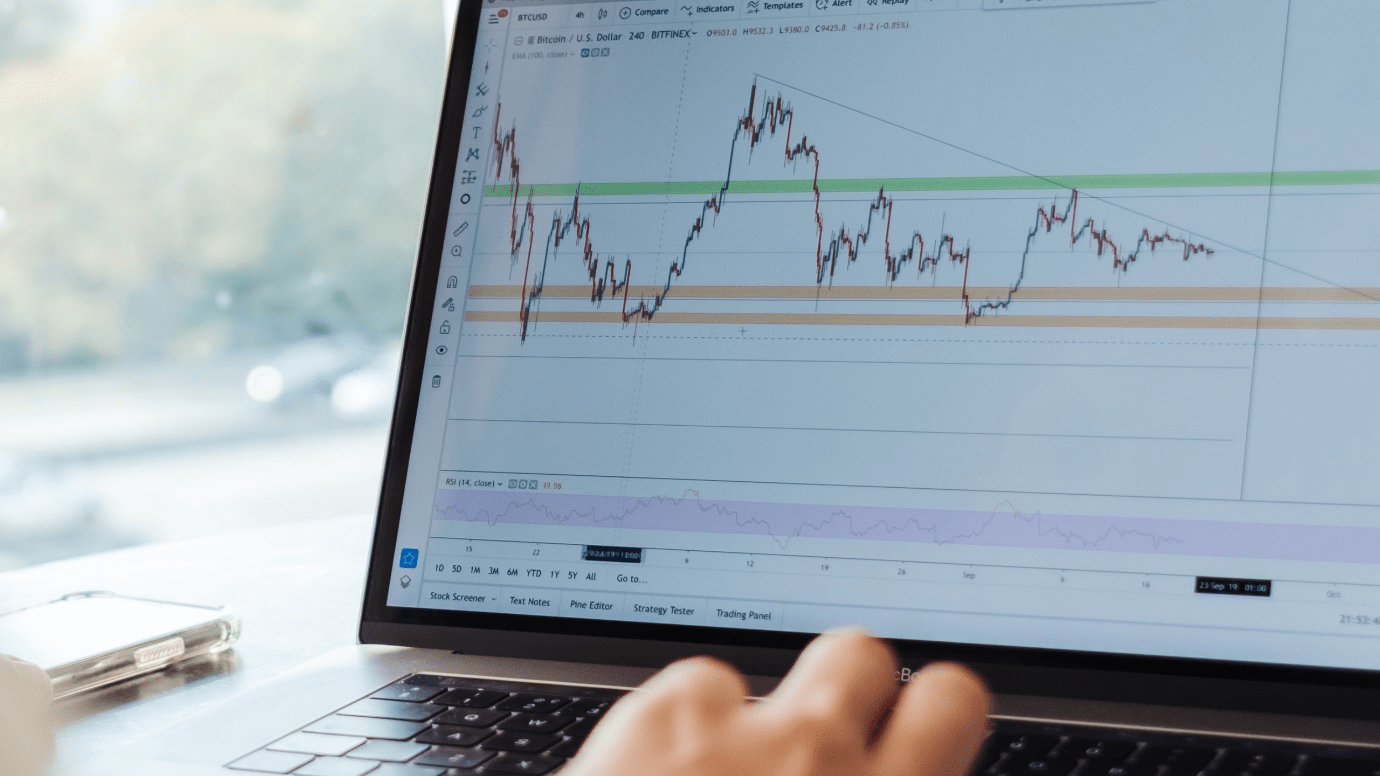

March 17, 2022: -On Wednesday, stock futures surged as traders tried to build on the sharp gains from the last session, while Wall Street awaited the Federal Reserve’s new monetary policy decision.

Futures on the Dow Jones Industrial Average climbed 359 points, or 1.1%, while S&P 500 futures increased by 1.2%. Nasdaq 100 futures surged 2%.

Micron Technology was from the best-performing S&P 500 stocks in the premarket, gaining over 4%. Starbucks shares climbed 3.5%, while Dow member Boeing advanced 2.3%.

Futures were rallying on signs that a ceasefire could be possible in the Russia-Ukraine war.

Ukrainian President Volodymyr Zelenskyy said a peace agreement was beginning to “sound more realistic” in addressing the nation Tuesday. Russian Foreign Minister Sergey Lavrov told the BBC there was “some hope of reaching a compromise.” Russian State media quoting the Kremlin echoed similar sentiments overnight.

The war between Ukraine and Russia has sent ripples through global financial markets, sending commodity prices sharply higher and stocks lower. However, some commodities have cooled off recently, while the U.S. equity market tries to find its footing.

U.S. oil traded at around $95.70 per barrel Wednesday, after topping a multi-year high of $130 earlier this month.

Stocks, meanwhile, are coming off a stellar session in which the Dow surged nearly 600 points, while the S&P 500 snapped a three-day losing streak.

To be sure, all eyes are on the Fed on Wednesday as the central bank wraps up a critical two-day policy meeting.

The Fed is widely expected to raise rates by a quarter-point, the first hike since 2018. Watchers expect the central bank to offer a new quarterly forecast indicating five or six more walks this year.

“My guess is it’s going to sound a little more hawkish than people want it to sound, and that’s going to be a little tough to digest, particularly in the fixed income markets,” David Zervos, chief market strategist at Jefferies, told CNBC on Tuesday. “I think the equity market might digest it a little bit better, but it’s going to be a tough swallow.”

The Fed is expected to announce an interest rate decision and economic projections at 2 p.m. on Wednesday, followed by a briefing from Federal Reserve Chair Jerome Powell.

The old prestige pyramid—where Ivy League degrees and blue-chip consulting backgrounds paved the way to the CEO seat—is cracking.

Loud leaders once ruled the boardroom. Charisma was currency. Big talk drove big valuations.

But the CEOs who make history in downturns aren’t the ones with the deepest cuts

Companies invest millions in leadership development, yet many of their best executives leave within a few years. Why?

The most successful business leaders don’t just identify gaps in the market; they anticipate future needs before anyone else.

With technological advancements, shifting consumer expectations, and global interconnectedness, the role of business leaders

The Fort McMurray First Nation Group of Companies is the wholly owned business entity of Fort McMurray 468 First Nation. It was established in 1987 as Christina River Enterprises, and the organization rebranded as FMFN Group in 2021. Providing Construction, Custodial, Petro-Canada Fuel & Convenience Store, and Transportation services to a broad portfolio of customers, the Group of Companies is creating financial stability and prosperity for the Nation.

Maushum Basu is a visionary leader who inspires his team with a clear, compelling purpose. Unafraid to take calculated risks, he understands that growth often stems from change and innovation. His deep commitment to both Airia Brands, Inc.

When speaking with Martin Paquette, one thing is immediately apparent: he’s honest. His transparency is refreshing. While many shy away from such vulnerability, Paquette sees it as a force to reckon with. The incredible emotional intelligence speaks to years of looking within—it’s also what allows him to acknowledge his mistakes gracefully and use them as opportunities to innovate.

Marina Charriere, CEO of Star Drug Testing Services, Star Drug Testing Services (Windsor Park), and First Defence Face Masks go hand in hand. Star is a drug and alcohol testing facility, and First D F M is a face mask company.

Leave us a message

Subscribe

Fill the form our team will contact you

Advertise with us

Fill the form our team will contact you