Why Skills-First Leadership Is Replacing the Ivy League Playbook in the C-Suite

The old prestige pyramid—where Ivy League degrees and blue-chip consulting backgrounds paved the way to the CEO seat—is cracking.

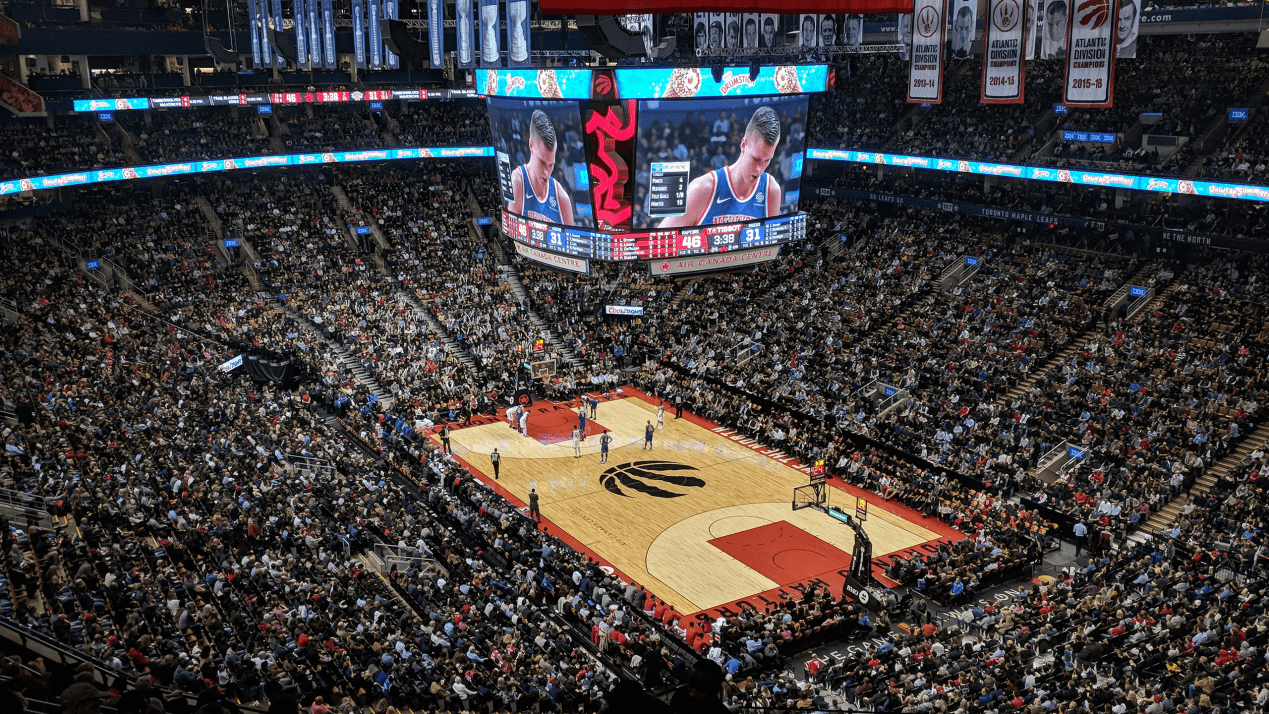

The National Basketball Association (NBA) is embroiled in a legal battle from its former marketing partnership with Voyager Digital, a now-defunct crypto lender. A group of aggrieved Voyager investors filed a class-action lawsuit on February 6, 2024, accusing the NBA of “gross negligence” for promoting the platform.

The lawsuit alleges that the NBA’s association with Voyager, including a promotional deal with the Dallas Mavericks, implicitly endorsed the crypto lender and misled investors. Plaintiffs claim this marketing contributed to their losses exceeding $4.2 billion during Voyager’s collapse in 2022.

Central to the lawsuit is the notion that the NBA, due to its reach and influence, served as a “gatekeeper” for financial products promoted within its ecosystem. The plaintiffs argue that this responsibility necessitates due diligence regarding any associated brands, particularly those in high-risk domains like cryptocurrency.

Furthermore, the lawsuit contends that the NBA, facing financial strains due to COVID-19, prioritized lucrative endorsement deals with crypto exchanges like Voyager despite inherent risks. According to the plaintiffs, this decision constitutes a deliberate embrace of potential dangers for financial gain.

While the lawsuit seeks class-action status, representing potentially numerous affected investors, it remains in its early stages. The defendants, including the NBA and specific teams involved in marketing partnerships, have yet to officially respond to the allegations.

Should the lawsuit proceed, the court will assess the validity of the claims and determine whether the NBA’s promotional activities with Voyager amounted to actionable negligence. This case can potentially set significant precedents regarding the liability of entities like professional sports leagues when endorsing potentially risky ventures like cryptocurrency exchanges.

The old prestige pyramid—where Ivy League degrees and blue-chip consulting backgrounds paved the way to the CEO seat—is cracking.

Loud leaders once ruled the boardroom. Charisma was currency. Big talk drove big valuations.

But the CEOs who make history in downturns aren’t the ones with the deepest cuts

Companies invest millions in leadership development, yet many of their best executives leave within a few years. Why?

The most successful business leaders don’t just identify gaps in the market; they anticipate future needs before anyone else.

With technological advancements, shifting consumer expectations, and global interconnectedness, the role of business leaders

Following a distinguished Law Enforcement career Joe McGee founded The Securitatem Group to provide contemporary global operational specialist security and specialist security training products and services for private clients, corporate organisations, and Government bodies. They deliver a wide range of services, including complete end-to-end protection packages, close protection, residential security, protection drivers, and online and physical installations. They provide covert and overt investigations and specialist surveillance services with a Broad range of weapons and tactical-based training, including conflict management, risk and threat management, tactical training, tactical medicine, and command and control training.

Jay Wright, CEO and Co-Owner of Virgin Wines infectious energy, enthusiasm, passion and drive has been instrumental in creating an environment that encourages talent to thrive and a culture that puts the customer at the very heart of every decision-making process.

Fabio de Concilio is the visionary CEO & Chairman of the Board at Farmacosmo, a leading organization dedicated to mental health and community support services. With a deep commitment to identifying and meeting customer needs, Fabio ensures that high standards are maintained across the board.

Character Determines Destiny – so said Aristotle. And David CM Carter believes that more than anything else. For David, it has been numerous years of research into codifying Entelechy Academy’s 54 character qualities that underpin everything he stands for as a leader and teacher.

Leave us a message

Subscribe

Fill the form our team will contact you

Advertise with us

Fill the form our team will contact you